The Lord Privy Seal is the fifth Great Officer of State (not to be confused with the Great Offices of State). However the Lord Privy Seal is not usually a Lord and is definitely neither a Privy (loo) nor a Seal (mammal)!

HMRC’s “Domestic reverse VAT charge for building and construction services” is causing much confusion. This is no great surprise as IMHO it is not domestic, doesn’t reverse anything and isn’t a charge. No wonder so many people struggle to understand it!

HMRC’s name of “Domestic reverse VAT charge” for these new rules is seriously misleading as it is:

- Not Domestic. In construction, a domestic means a private consumer eg the RIBA Domestic Building Contract. In Government parlance though “domestic” means UK as opposed to EU/overseas (think of a domestic flight). The new rules apply where the supply chain is all in the UK. They specifically do not apply to domestic customers.

- Not a Reverse. Reverse implies going backwards to where you started. This change doesn’t send anything back to where it started but it transfers VAT outputs up the supply chain. Reverse charge in the rules refers to responsibility for accounting for the VAT on the supply moving (not reversing) from the subcontractor to the main contractor.

- Not a Charge – Charge implies a new cost (eg HICBC – High Income Child Benefit Charge which is a new tax). This is not a new charge, cost or tax – it is different way of treating/administering existing VAT.

HMRC have announced that its commencement on 1 October 2019 has been delayed for one year to 1 October 2020. Perhaps if they had found a better name for it, the industry might have understood it rather more easily rather than losing the will to live over it!

I would have called the new rules something like ToRVOS (Transfer of responsibility for VAT outputs for subcontractors) not the “Domestic reverse VAT charge” rules. So what is the misleadingly titled “Domestic reverse VAT charge for building and construction services?”

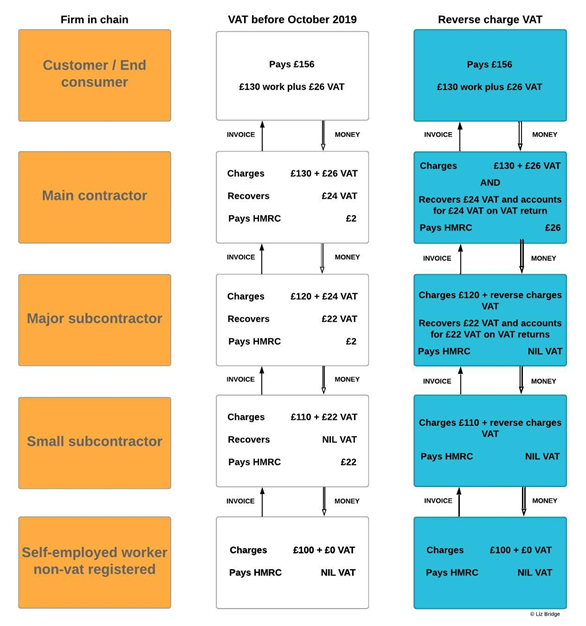

Put simply the new rules move responsibility for charging VAT up the construction supply chain. In a phrase the rule can be summed up as “Subbies no longer charge output tax”. It affects VAT registered businesses subject to CIS (Construction Industry Scheme).

In the domestic reverse VAT charge regime, VAT registered subcontractors no longer charge VAT to their customers (and thus have no output VAT to pay to HMRC) as long as those customers are not end users. Subcontractors account for input VAT they have incurred in the usual way and thus many subcontractors will now receive VAT rebates each quarter.

Main contractors will in future pay a larger quantum of VAT to HMRC as they will no longer have a VAT payment to make to their subcontractors.

In practice it can be thought of as a clever scheme to make the subcontractor more like a branch of the main contractor for VAT output purposes.

VAT output is no longer to be accounted for by subcontractors but instead by the last main contractor in the supply chain (provided all contractors are in the UK and are both CIS and VAT registered)

In order that HMRC can keep track of the VAT that is now being treated differently, main contractors will include the output VAT that the subcontractor would have shown on the subcontractor’s VAT return on their main contractor’s return instead (think of it like a fictitious but legally required entry). To avoid this sum actually being paid (and thus HMRC being paid twice!) an equivalent fictitious sum will be included as input tax on the VAT return of the main contractor.

A picture makes it much easier to grasp (the new rules now come into force in October 2020):

Image is copyright © Liz Bridge and The Construction Index and is reproduced with permission.

What needs to be done to be ready for the start of the domestic reverse charge?

By the introduction date of 1 October 2020:

- check whether the reverse charge affects either your sales, purchases or both

- make sure your accounting systems and software are updated to deal with the reverse charge

- consider whether the change will have an impact on your cash flow

- make sure all your staff who are responsible for VAT accounting are familiar with the reverse charge and how it will operate

What contractors need to do

If you’re a contractor you will also need to review all your contracts with sub-contractors, to decide if the reverse charge will apply to the services you receive under your contracts. You’ll need to notify your suppliers if it will apply.

What sub-contractors need to do

If you are a sub-contractor you will also need to contact your customers to get confirmation from them if the reverse charge will apply, including confirming if the customer is an end user or intermediary supplier.

End users

The reverse charge does not apply to consumers or final customers of building and construction services. Any consumers or final customers who are registered for VAT and CIS will need to ensure their suppliers do not apply the reverse charge on services supplied to them. For reverse charge purposes consumers and final customers are called end users. They are businesses, or groups of businesses, that do not make onward supplies of the building and construction services in question, but they are registered for CIS as mainstream or deemed contractors because they carry out construction operations, or because the value of their purchases of building and construction services exceeds the threshold for CIS. Find out more about end users and intermediary supplier businesses.

Background to the “Domestic reverse charge” in construction

A domestic reverse charge means the UK customer who get supplies of construction services must account for the VAT due on these supplies on their VAT return rather than the UK supplier. This removes the scope for fraudsters to steal the VAT on sales (outputs) due to HMRC as they no longer collect the VAT from their customers. It follows similar measures introduced in response to criminal threats for mobile telephones, computer chips, emissions allowances, gas and electricity, telecommunication services and renewable energy certificates. Many EU countries now have similar rules.

The Government first confirmed it would be taking this measure forward in the Autumn Budget 2017. A technical consultation on the draft legislation and its impact took place in summer 2018 and the final legislation and guidance were published in November 2018. The industry was not ready by the implementation date of October 2019 hence the delay to October 2020. The real risk though is that construction firms will just put off preparation yet again.

The long lead-in time was to allow for potential cash-flow and administrative impacts the change could have on subcontractor businesses. Businesses need to adapt their accounting systems for dealing with VAT and there will be a negative impact on the cash-flows for many affected businesses, as they will no longer get VAT payments from customers for services where the reverse charge applies.

Of course the detail of how the new rules will work in practice is hugely complex and the guidance is set out by HMRC at https://www.gov.uk/guidance/vat-domestic-reverse-charge-for-building-and-construction-services

Welcome to my world of ToRVOS – Transfer of responsibility for VAT outputs for subcontractors!

David Eaton

David is a Chartered Accountant and Partner in SME Strategies and a former finance director in the construction sector.

I am so pleased we have left the EU so that we can now implement simple and easy to follow regulations that have an obvious benefit for all concerned.

This sums it up perfectly! Sadly!